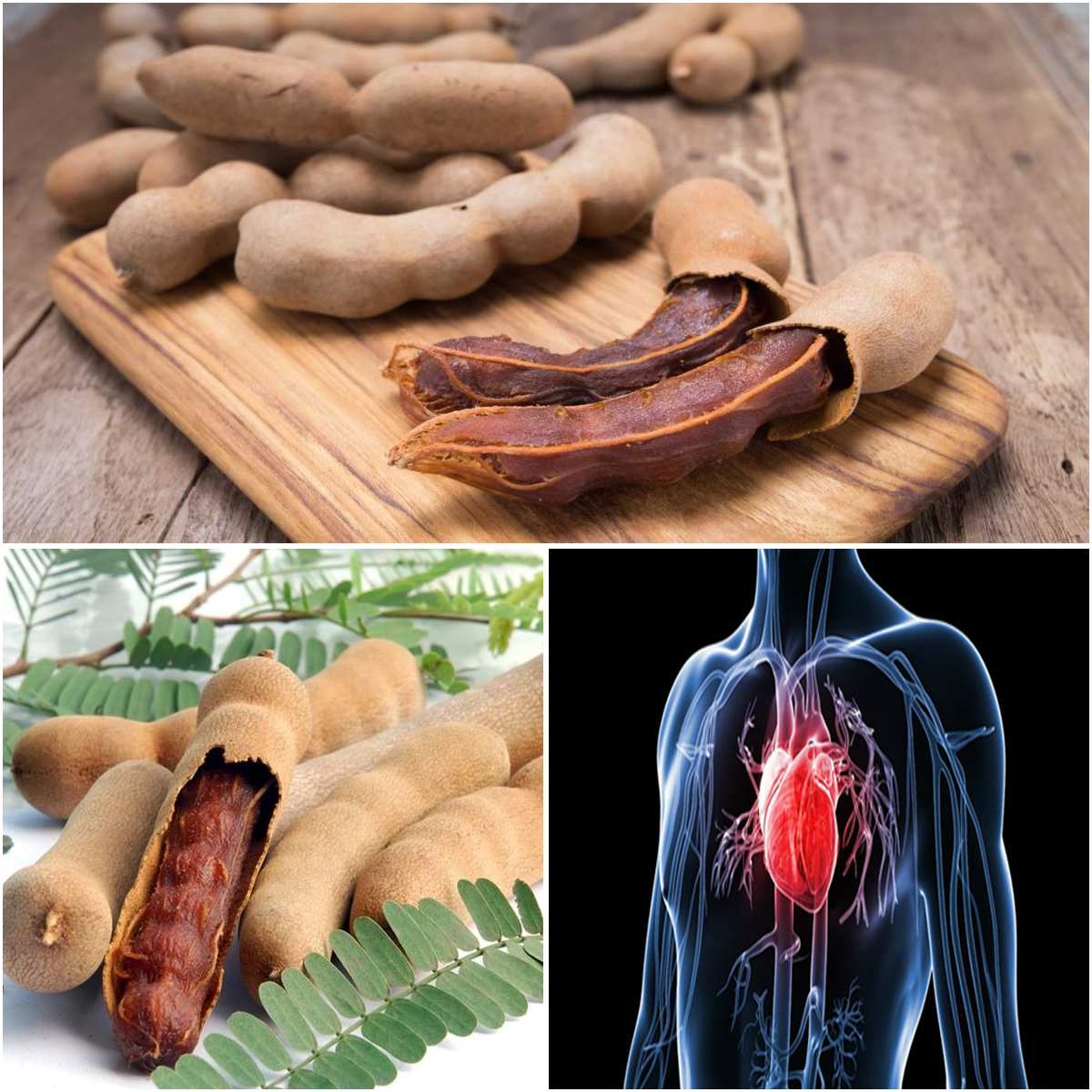

Tamarind isn’t just a delicious tropical fruit—it’s a powerhouse of nutrients with incredible health benefits. Whether you enjoy it fresh, as a paste, or in your favorite dishes, tamarind has a lot to offer. Here are five surprising reasons why you should eat more tamarind starting today!

🍽 1. Supports Smooth Digestion

Struggling with digestion? Tamarind has been a natural digestive remedy for centuries. Packed with fiber, it helps regulate bowel movements and prevent constipation. Plus, its natural acids—tartaric, malic, and citric—stimulate digestion and keep your gut happy.

🛡 2. A Powerful Antioxidant Boost

Tamarind is loaded with antioxidants that fight free radicals, slowing down aging and reducing the risk of chronic diseases. With polyphenols and vitamin C, it helps lower inflammation, protect your cells, and keep your body in top shape.

❤️ 3. Promotes a Healthy Heart

If you care about heart health, tamarind should be on your plate. It helps lower bad cholesterol (LDL) while increasing good cholesterol (HDL). Plus, its high potassium content supports healthy blood pressure, reducing the risk of heart disease.

💪 4. Strengthens Your Immune System

Tamarind is naturally rich in vitamin C and antimicrobial compounds that help your body fight off infections. It has been used in traditional medicine to combat bacteria, viruses, and even fungal infections, keeping you strong and healthy.

🚀 5. Detoxifies Your Body Naturally

Need a natural detox? Tamarind helps cleanse your liver and kidneys by flushing out toxins. Studies suggest it can even help remove heavy metals like lead from your body, making it a fantastic natural cleansing agent.

How to Enjoy Tamarind?

Tamarind is incredibly versatile—here’s how you can add it to your diet:

✔ Eat the raw fruit or tamarind paste.

✔ Add it to sauces, curries, and soups for a tangy kick.

✔ Make a refreshing tamarind drink or tea.

✔ Use it as a natural sweetener in desserts.

With all these benefits, tamarind is more than just a tasty fruit—it’s a superfood packed with goodness. Start incorporating it into your meals and experience its amazing health perks today!

The Net Worth Rule For Car Buying Guideline

194 Comments / By Financial Samurai / 10/12/2024

Are you looking for a car buying guideline? Do you think my 1/10th rule is too harsh? If so, do not fret! Let me also introduce to you the net worth rule for car buying guideline to follow.

The net worth rule for car buying is generally reserved for wealthier people or retired people with a lot of assets, but not a high income. Ultimately, we all want to be wealthy based on a high net worth that is taxed more favorably.

How The Net Worth Rule For Car Buying Came About

I came up with the net worth car buying guideline because my 13-year-old Land Rover Discovery II was starting to give me fits back in 2013. His cruise control had just died and I was starting to worry about car safety, which is everything if you have a family.

I had just spent $800 that summer on a new steering pump, timing belt, and 125,000 mile tune up. So it was disappointing to see another issue come up.

Besides the cruise control not working, the brakes are mushy, the airbags haven’t been serviced at the 10 year mark, the traction control and ABS lights are on, and a couple $220 M+S tires are balding.

Oh yeah, the CD player doesn’t work either and there’s no bluetooth of course! My trusty mechanic of 12 years said Moose was operationally fine. The dashboard lights are just on due to a broken fuse lodged deep inside the control panel that makes it not worth replacing. Still, I had my doubts.

I wanted to buy a new car! But I also had just retired in 2012 and no longer earned six-figures in finance. I’m other words, I was asset rich, free cash flow poor.

Based on the 1/10th rule for car buying, I can buy a new compact car. The problem is, I wanted to buy the latest Range Rover Sport that costs $90,000! Let’s see if there is a car buying guideline to help get me and you what we want.

The Net Worth Rule For Car Buying

The net worth rule for car buying states that you can spend up to 5% of your overall net worth on the purchase price of a car. For example, if you have a $1 million net worth, you can spend $50,000 for a car. If you have a $3 million net worth, you can spend up to $150,000 for a car.

If you have a $500,000 net worth, you can spend up to $25,000 on a car. However, if you’re rocking a $10 million net worth, the ideal net worth amount for retirement, you could conceivably spend up to $500,000 on a car. Thankfully, there aren’t that many of those unless you’re going the supercar or collector’s car route.

The 1/10th rule only accounts for one’s annual income when deciding on how much to spend on a car. Perhaps a greater barometer to determine car spending is your overall net worth.

After all, if you can live in a 100% paid off $5 million mansion and live off $150,000 a year in disposable income you’re much better off than somebody who earns $300,000 a year with no assets to speak of.

Based on my net worth by income post, a 30 year old should have roughly 2X their salary in savings or overall net worth e.g. $60,000 annual income = $120,000 net worth.

Hence, to keep consistent with the 1/10th rule for car buying and my net worth by income calculations, I think spending 5% or less of one’s net worth on a vehicle works very well (5% X $120,000 = $6,000 = 10% X $60,000).

Rewarding Older Car Buyers Who’ve Saved And Invested For Decades

The net worth rule for car buying covers those who’ve retired, are temporarily out of a job, are a stay at home spouse, have a medical condition and can’t work full time and so forth.

Let’s say you worked for 40 years and accumulated a $1 million net worth by the time you are 65 through diligent savings and investments. You’re now living off roughly $60,000 a year from social security, dividends, and a pension.

The 1/10th rule says you can only buy a $6,000 car which seems much too onerous for a person of your stature. It’s time to live it up a little! My net worth rule provides a guideline for the retiree to buy up to a $50,000 car instead.

Net Worth Guideline By Income Chart

Below is the net worth guideline by income chart for your review. As you can see below, a 50 year old person who makes $200,000 a year and has a $3,000,000 net worth should feel comfortable spending up to $150,000 on a sweet Porsche 911 CS instead of just $20,000 on a Honda Civic.

Whether he does or not is another matter. If I’m sporting a $2.4 million net worth and $200K income, I’m still driving a $20,000 car, because $3 million is the new $1 million thanks to inflation.

Car Recommendations By Net Worth Amount

Cars are so much fun. I understand every single one of you who salivate over the latest model sports car, SUV, or electric vehicle. But cars are also the biggest money wasters. Follow my car buying guideline. Nobody really needs a car that costs over $5,000. Cars built after 2000 are so much more reliable than those building in the 70s, 80s, and even 90s.

Here are a list of car examples you can consider based on your current net worth. Obviously, the higher your net worth, the nicer and more expensive of a car you can buy. But if you haven’t gone to a car dealership recently, I think you’ll be shocked. New luxury car prices are outrageously expensive now. We’re talking $115,000 for a Range Rover Sport and a $150,000 for a Mercedes Benz EQS 650!

Don’t Forget About Opportunity Cost When Buying A Car

The money we spend on cars could be invested in real estate or stocks that will super charge our net worths. The money you would have invested in the stock market or real estate market when I first wrote this post in 2013 is now worth more than quadrupled in 2024!

I’d like every car buyer to think in terms of opportunity cost when making a decision on which vehicle to get. Every time I think about plunking down $50,000 on a new BMW, I shudder to think how it could turn into $100,000 10 years later if it grows at 7.2% a year.

In 2018 I invested $50,000 in Tesla stock while my preschool teacher friend bought a $50,000 Model 3! My Tesla stock can now buy me three Model 3s for free. This is why it can be so hard for investors to spend money.

In 2015, I bought a $1.52 million single-family house with $320,000 down. Instead of buying a nice fancy car, I bought a used $8,000 Land Rover Discover II and drove it for 10 years until it was worth only $2,200. I then sold the house in 2017 for $2.75 million, walking away with about $1.78 million after taxes and fees.

That was a life-changing amount of money that brought a tremendous amount of financial security once I became a father.

Keep Your Car Spending Under Control

If you’re still on your financial independence journey, where your passive income doesn’t cover your basic living expenses, I encourage you to own a cheaper car. I also recommend you follow my House-To-Car Ratio for financial freedom. Get to a ratio of 50 or higher and you’ll build more wealth over time.

You want to own more house and less car. At the same time, you don’t want your primary residence to account for more than 50% of your net worth. It’s important to diversify and have your net worth actively working for you.

Basing a car buying decision on one’s net worth may actually be harder than basing a decision based on income. Our net worth is a lifetime achievement whereas income is only one year at a time.

Are we really comfortable spending 1/20th of our lifetime’s work on a depreciating vehicle? Maybe, but that should certainly be the max.

Invest In Real Estate Instead Of A Car

Instead of paying a lot of money for a fancy car, buy a more modest car and invest the rest in real estate. Real estate is my favorite asset class to build long-term wealth. While cars are guaranteed to depreciate, real estate tends to appreciate over the long term.

To invest in real estate without all the hassle and unexpected costs, check out Fundrise. Fundrise offers funds that mainly invest in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher. The firm manages over $3.5 billion in assets for almost 400,000 investors looking to diversify and earn more passive income.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside due to higher growth rates. You can build your own select real estate portfolio with Fundrise.

I’ve personally invested $954,000 in private real estate since 2016 to diversify my holdings, take advantage of demographic shifts toward lower-cost areas of the country, and earn more passive income. We’re in a multi-decade trend of relocating to the Sunbelt region thanks to technology. Both platforms are long-time sponsors of Financial Samurai and Financial Samurai is currently an investor in Fundrise.

The Net Worth Rule For Car Buying is a Financial Samurai original post. Use the car buying rule if you have a lot of assets, but not a lot of income. A car is a depreciating asset. Please buy responsibly.

Join 65,000+ others and sign up for my free weekly newsletter. This way, you’ll never miss a thing and increase your chances of achieving financial freedom.